Do you feel lost on how you can manage your money with taxes, investments, or any financial concerns? Do you feel like you need help in a crucial situ

Do you feel lost on how you can manage your money with taxes, investments, or any financial concerns? Do you feel like you need help in a crucial situation and self-struggle about handling your money and debts? Any money-involvement situation can be tough, especially when you literally have zero knowledge of taxes, investment, and financial concerns. Even asking for help from a Certified Public Account can be useless because vague advice is not even a great solution to the current problem of your investment. Also, do you feel that you are not the only one having a bad situation with money? I understand all those thoughts, and The Ramsey Show can help you with your money journey.

What The Ramsey Show Is All About

The Dave Ramsey Show was a former name of a podcast hosted by Dave Ramsey, now named “The Ramsey Show.” Their program started around 1992. And takes live calls from people struggling with their money situation. They also provide financial advice or solutions for Live Callers seeking help with their money management situation.

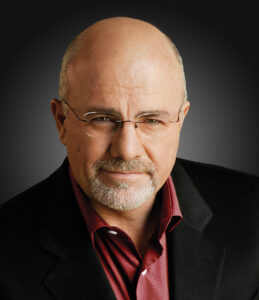

David Lawrence Ramsey III – an American personal finance personality, radio show host, author, and businessman

The podcast is so popular that it has millions of listeners, giving audiences a positive impression.

The host, Dave Ramsey, is a well-known best-selling author, CEO of Ramsey Solutions, and a personal finance guru. Dave has a strong personality and is direct in encouraging his callers to avoid wasting their money on an unnecessary investment. He even applies his Christian principles to improve the caller’s money situation. Other than that, he also calls out unethical actions of companies who take advantage of the caller’s situation.

The podcast is inspirational and thoughtful, as their program aims to help people who struggle with their investment and financial concerns. The host and co-host are direct and firm with their investment advice. However, they provide empathy for the caller’s case of money management.

Why You Won’t Want To Miss This Podcast

In all honesty, this podcast is unique for an investment podcast because I noticed all the investment podcasts that I have listened to bring guest speakers who are financial advisers for the episode.

The Ramsey Show focuses on callers and how to help them realize their mistakes in managing their investments. It also seeks to convince those who trust their financial needs. Other than listening to the caller’s money management mistakes, other callers are seeking financial advice. This advice can relate to their family situation, which can get cultural or religious.

I love how they provide empathy toward their callers’ situations. Their financial advice is on-point on the caller’s situation and guides them on what they may be able to do to aid their callers’ money situation. I also appreciate Dave Ramsey’s Christian Principles for helping their financial stress, especially in investment and family situations. I understand how they make their callers comfortable talking about their investment’s condition and reassure them that their inquiries are valid.

Dave Ramsey’s team of advisors provides financial advice. They also recommend self-help books for the callers that relate to their situation, even if it is not Dave Ramsey’s book. I can see how humble Dave Ramsey is on that part as he does not advertise his products first.

The length of episodes from the podcast is not too much or not too short since they receive almost 4-5 callers within the episodes. Also, it does not make me bored to listen to each caller within the episode because it is somehow relatable. The hosts’ empathy touches the heart of the caller and also the listeners of this podcast.

Some Of The Key Takeaways From The Podcast

- Live within your means: The Ramsey Show encourages people to live within their means by setting a budget and sticking to it. This means that you should only spend what you can afford. And if you are struggling, then look for ways to cut back to prevent debt and overspending.

- Pay off debt: The podcast inspires people to pay off their debt quickly. This means that, instead of making minimum payments, one should look for ways to pay off debt faster. This can be done by creating a budget, negotiating with creditors, and consolidating debt.

- Build an emergency fund: It advises people to build an emergency fund. This fund should be large enough to cover at least six months of expenses. This helps to prepare for any unexpected expenses that may arise, such as a medical bill or a car repair.

- Invest for the future: The show motivates people to invest. This can be done by investing in stocks, bonds, and mutual funds. This helps to ensure that one’s money will grow over time and that one can enjoy the fruits of their labor.

- Give back: The Ramsey Show also urges people to give back to their community. This can be done through charitable donations, volunteering, or even helping a needy neighbor. This helps to spread positivity and goodwill throughout the community.

COMMENTS